Jason Cohen knew — probably before anyone else — that the profitable era of cable television as the industry’s content gatekeeper was coming to an end.

As a hedge fund guy employed by a large financial firm, a big part of Cohen’s job was to spot industry trends — identify the winners and the losers — that would earn his company and its clients more money. He focused on various sectors, including entertainment and media that have undergone seismic shifts over the last few decades thanks in large part to advancements in technology.

Around 2010, Cohen began observing a change in the way people were watching TV. Internet speeds reached a point where people grew comfortable watching TV over streaming services like Netflix, Hulu Plus and Sony’s Crackle. Those streaming services were investing in better content, and ordinary people were launching compelling, high-quality video blogs on YouTube that rivaled the best shows and movies on cable.

At the same time, those same cable companies were partnering with networks to offer complementary streaming apps that would allow subscribers to access top-rated TV shows one day after they aired on broadcast or cable TV as well as back catalogs of network programming. The thinking was, if customers could access more content on their own time, they’d be more likely to keep their cable TV subscriptions active.

Cohen didn’t see things that way: He saw the Internet as a major threat to the traditional pay TV platform, and he began advising and investing with that thought in mind.

“I started to put together this thesis back in 2013 that the TV bundle is dead — that the traditional TV bundle is dead, and that the Internet was going to have a tremendous impact on the media, TV and Internet ecosystem,” Cohen said during an interview with The Desk earlier this month. “As the years went on, we invested accordingly, and it started to happen — and then, all of a sudden, it really started to pick up speed.”

From 2013 to 2019, Cohen watched as one streaming service after another launched. New services like Dish Network’s Sling TV and Google’s YouTube TV sought to replicate the cable TV market but with online offerings that promised consumers cheaper prices and the flexibility of watching live channels on the device of their choosing. Other services, like HBO Now, offered the same shows found on its TV networks but made them available to those without a cable subscription for the first time.

As time went on, content became more abundant, hardware and software costs became cheaper and streaming services began exploding in number and size. That got Cohen thinking about how customers could possibly sort through all of the streaming services on the market — he estimates there’s hundreds today — to find the content they want to watch at a price they feel they can afford.

Cohen began working though this problem with his brother, Daniel Cohen. The Cohen brothers brought complementary skills to the table: Both had business acumen, but Daniel brought digital development skills with him, while Jason had a keen eye for monitoring consumer and economic shifts and trends. (Jason Cohen was interviewed for this story.)

In early 2019, the Cohen brothers decided to develop a tool that would help consumers pick streaming services based on the type of content they wanted to watch — whether it be live sports and news like what they’d find on cable or documentaries, movies and general entertainment shows like what they could find on an ever-growing number of streaming-only services. A few months later, they had MyBundle.TV, a tool that offered suggestions on streaming services based on a brief user survey.

Cohen said the idea wasn’t to move people away from cable services — customers still need broadband Internet, after all, and that’s the type of service most cable companies provide — but to get TV viewers away from the cable box, which was once the gatekeeper of premium content but was increasingly made obsolete by streaming upstarts like HBO Now, Hulu and others.

“The Internet was key to breaking that relationship where one cable company really has you by the blank,” Cohen said. “You can get your Internet from somewhere different, your streaming device from someone different and your streaming services from someone different.”

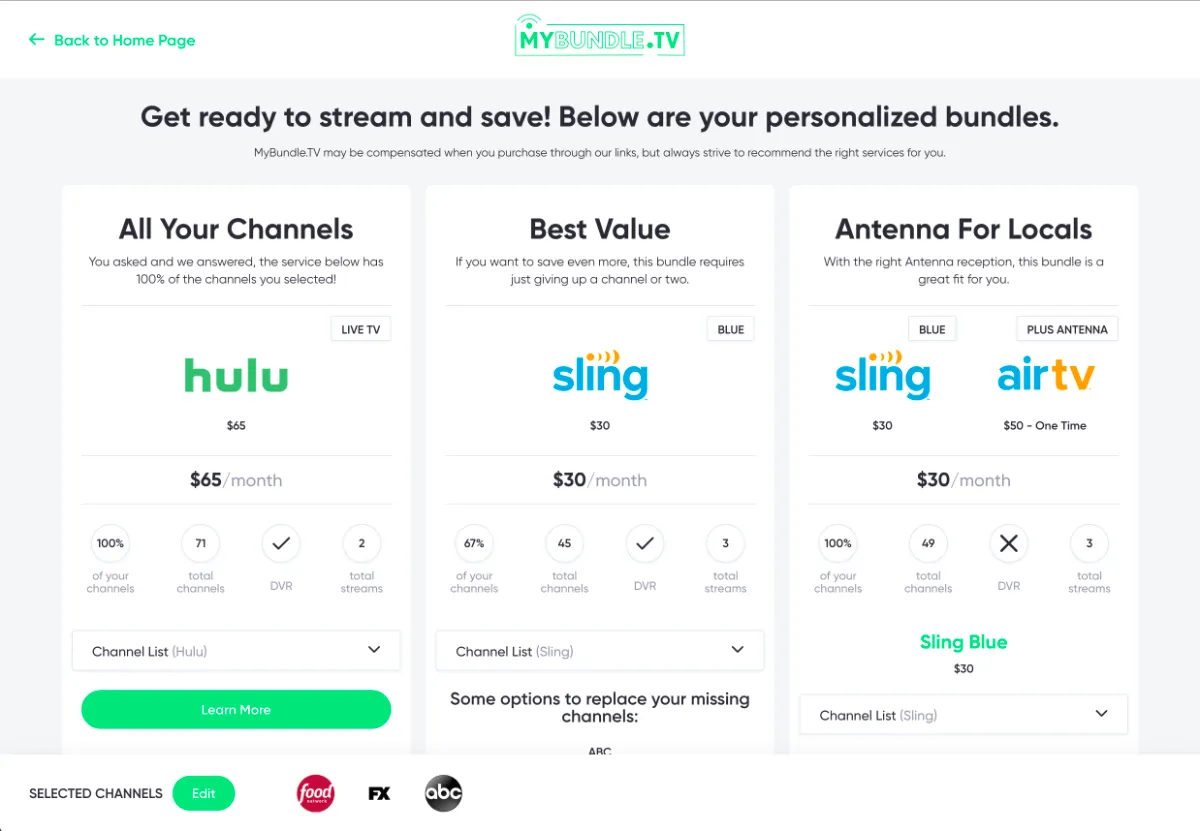

MyBundle.TV helps customers fill in the last part of that equation by taking streaming services together and organizing them as a new type of television bundle (hence the name). After users offer up a few details like their zip code, the number of people in their house and the types of cable-like channels they “need” (they’re told the more they’re willing to part with, the cheaper their “bundle” will be), the tool then offers up a few suggestions on streaming cable-like services, on-demand services and even antennas that it thinks streaming customers will find valuable.

Like other streaming recommendation engines, MyBundle.TV earns a commission from some partner services that are included in its tool. But the tool also offers up services that don’t have an existing relationship with MyBundle.TV, and Cohen says the recommendation engine prioritizes services based on a customer’s programming needs, not on affiliate agreements.

Cohen said the tool is valuable for customers who feel overwhelmed by their options. It also helps educate people moving away from the traditional cable or satellite bundle on the vast amount of content services that are on the marketplace and help expose some of the smaller players to a bigger audience. What he didn’t consider is how valuable MyBundle.TV might be to the very cable companies he was challenging.

Last year, a representative from a small regional cable company in Georgia reached out to Cohen. The company, Point Broadband, really wanted to break away from the pay TV side of the industry: Like other cable companies, the high cost of programming was forcing them to raise customer bills.

Point Broadband tried to convince customers to keep their Internet service while steering them toward services like Sling TV and YouTube TV, but they soon realized customers didn’t want to invest time and attention and researching all of the different streaming TV options out there. That’s just the kind of problem MyBundle.TV was built to solve.

“When Point Broadband saw our tool, they said, hey, do you think you could do this for us?” Cohen said.

The Cohen brothers hadn’t considered integrating MyBundle.TV with an Internet provider — they just assumed Internet customers who wanted streaming TV would find and use the tool on their own. But they had nothing to lose by partnering with Point Broadband, so they signed an agreement and got to work developing a white-label version of their tool to integrate with Point Broadband’s website.

Then a bigger fish came calling.

“CenturyLink comes to us, and they’re looking for a solution also,” Cohen said. “That was the a-ha! moment for us.”

It turns out, the original vision behind MyBundle — that the cable TV bundle was going to be replaced by customers choosing a handful of streaming services — was on the mind of executives at CenturyLink and other cable companies that the Cohen brothers had bet against.

“They said, look, our cable bills are insane, we feel terrible for our customers and we’re losing money,” Cohen said. “We can’t continue to pass on these high programming costs every year, and, frankly, we just want to give customers Internet.”

Even worse, when customers called to cancel, they often weren’t just dropping their cable TV service — they were cancelling everything, including their home Internet. But the white-label version of MyBundle.TV offered Point Broadband and CenturyLink subscribers a reason to stay: It signaled to customers that they could keep their Internet service (which would often lower their bills) while getting TV programming through one or more streaming services — and here’s a tool, right on our very own website, to help you figure out what you should get.

“The a-ha! moment is getting more a-ha!-ish as we are winning more partners,” Cohen said. “It’s definitely building momentum.”

As of today, MyBundle.TV has around a dozen partner ISPs offering white-label versions of their tools to customers that they hope will break away from their pay TV packages and convert to Internet customers. (Some version of MyBundle.TV do recommend traditional pay TV packages from partner companies based on a narrow set of criteria.)

“The smaller and medium-sized cable companies – they’re done,” Cohen said. “They are looking to get out of video. The line we keep hearing is, video is 95 percent of my complaints and zero percent of my profits.”

As of December, the Cohen brothers had signed up around a dozen partner ISPs — mostly regional cable companies — for the white-label version of MyBundle.TV. Cohen didn’t say exactly how much is charged for native integration, but he said if partners “can get one new subscriber per year, it pays for itself.”

The tool is now in front of 5.6 million broadband Internet customers — and that’s not counting the thousands of people who use the tool on MyBundle.TV’s standalone website each month. Just as MyBundle.TV helps solve a big problem for the company’s partner ISPs, that scale of exposure solves a big problem for MyBundle.TV: The service continues to rely on commissions as a big driver of its revenue, and the scale of exposure convinces streaming services to make those affiliate deals.

“When we approach them, we’re not some scrappy company,” Cohen said. “We’re saying, hey, we’ve got 5.6 million customers with our current partners — that’s 5.6 million now, but we think we can get to 15 or 20 million soon — do you want to be involved in that?”

Cohen believes streaming services will be convinced to sign up for what MyBundle.TV has to offer now and what’s in store for the future: A platform that allows customers to manage most, if not all, of their subscriptions from within MyBundle.TV itself.

“If you’re an ISP, we’re charging very, very little because we have this bigger plan,” Cohen said. “We’re not looking to maximize revenue today. We’re looking to maximize our partners. As we get more technology, more product, more content, more affiliate relationships, we generate more revenue for our partners — and that just sweetens the deal.”